In 25 years, the world has changed dramatically. Back in 1999, the internet was still in its infancy—think slow speeds, basic websites and bright, pixelated logos. The dotcom bubble was rapidly inflating, and with it came a wave of internet-first companies facing unfamiliar cyber risk. It was clear these companies needed a new type of protection. That’s where CFC came in, pioneering cyber insurance to help safeguard businesses of the future.

What began in 1999 as a simple idea has grown into a global business known for innovation and leadership across the industry. Safe to say, it’s been an incredible journey. Thanks to the support of our broker partners and the passion, dedication and energy of our people, we’ve steered economic downturns and times of extraordinary change.

What better way to celebrate our 25th anniversary than a look back at where it all started and where we’re heading next.

Riding the dotcom wave: How it all began

The late 1990s were a time of explosive change. The dotcom boom was in full swing, and the internet resembled the Wild West—full of promise, opportunity and fast-moving innovation. As thousands of new digital businesses emerged, so too did cyber risk. Cyber threats from widespread viruses to email worms (used by cybercriminals to infiltrate inboxes) came to the fore, raising the need for network protection. While this prompted large corporates to begin exploring cyber cover, smaller businesses were getting left behind due to complex wordings, lengthy proposal forms and unaffordable premiums.

CFC set out to address this gap in the market. Our goal was to make specialty insurance accessible, understandable and genuinely useful for businesses of all sizes. That meant doing things differently.

By simplifying the insurance process and beginning to expand our portfolio—covering technology errors and omissions, general liability, property and casualty, professional indemnity and more—businesses could get all the protection they need, all in one place, instead of purchasing multiple policies to cover different risks.

From local roots to global reach: CFC expands overseas

By 2008, we had outgrown our space in the iconic Lloyd’s building. While it had served as the perfect launchpad, we were ready for a home that reflected our evolving identity and ambitions. The move to 85 Gracechurch Street marked a major milestone, a space we could shape as our own and grow into the future.

And grow we did. Each year, we added new floors to our office and welcomed fresh talent through our doors. Many joined CFC from large, established insurers, bringing with them deep expertise and a hunger to do things differently. That combination of experience and entrepreneurial spirit propelled us into new lines of business, from product recall to kidnap and ransom to transaction liability.

But our focus wasn’t just on product innovation—we were also rethinking how those products reached the market. From the beginning, our team took to the skies, building relationships and sharing our expertise across the globe. From South Africa to Sweden, Ireland and Australia, we worked closely with brokers to help them and their clients understand the complexities of cyber and emerging risks.

As CFC’s global footprint grew, we began to expand internationally. We started by acquiring cyber security hubs in Texas and Brisbane, strengthening our technical capabilities. And in 2019, with 40% of our business already coming from the US, we opened our first international underwriting hub in New York.

Tomorrow, together: Powering the next 25 years

Today, CFC stands as a truly global business, with offices across Australia, the US, Canada and continental Europe, protecting 200,000 customers in over 90 countries. It’s a milestone we’re incredibly proud of; not just for the scale we’ve achieved, but for how we’ve achieved it.

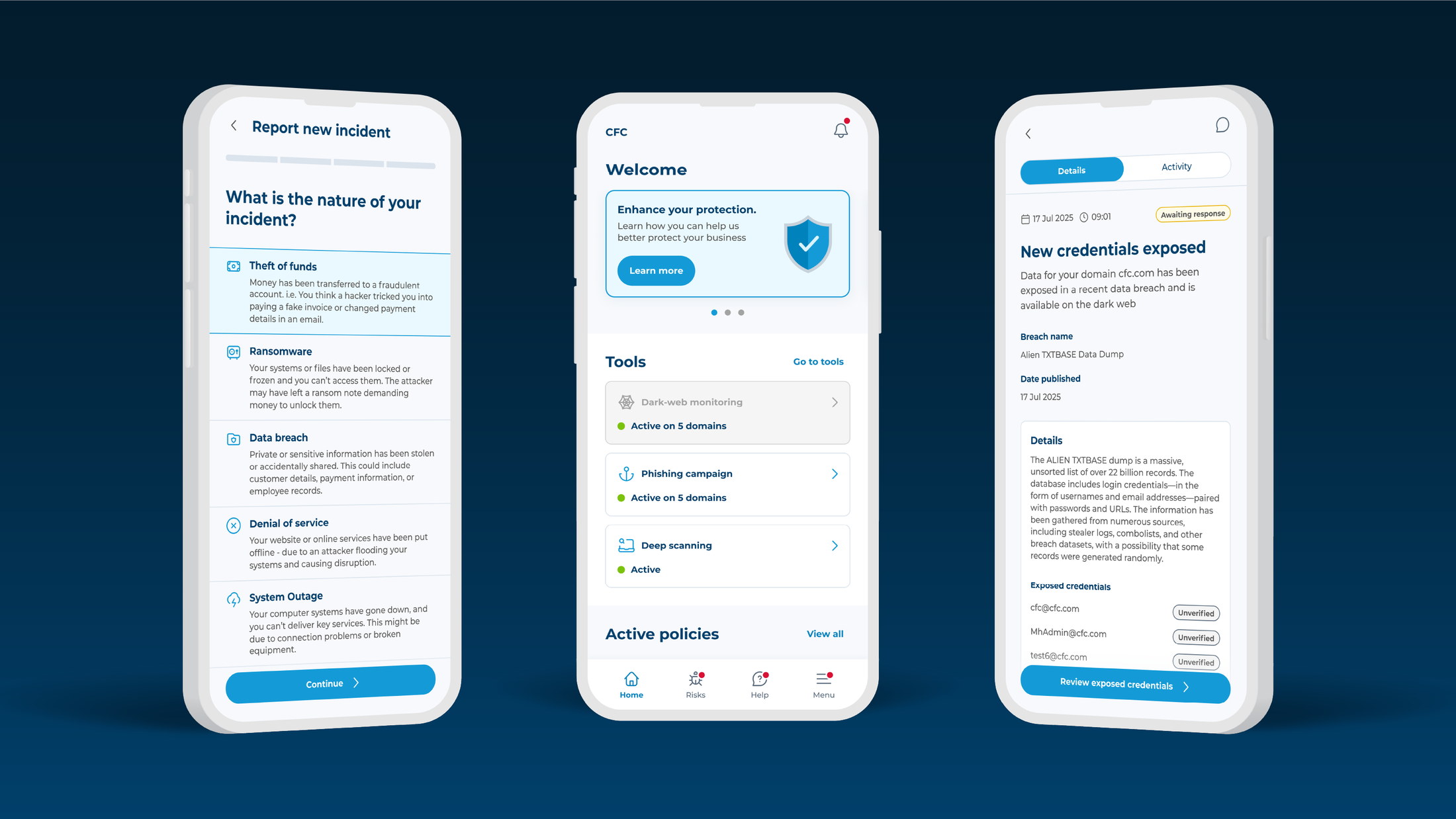

From disrupting the specialty insurance market for SMEs to developing technology like Connect, the broker trading portal, CFC’s focus has always been on making it easier for brokers to trade. And for businesses of all shapes and sizes to find comprehensive insurance cover.

Just as important is the culture that’s helped power CFC's growth. The CFC team is built on passion, integrity and the commitment to innovate—while having fun doing it. These values will continue to guide CFC through the next stage of our journey.

Looking ahead, the ambition is to keep building on this momentum. That means two things: one, staying at the forefront of technology, by building platforms and systems that free teams from manual tasks so they can spend more time where it matters—with brokers; and two, continuing to invest in CFC’s people, to create an environment where they can bring their whole selves to work and be the best at what they do.

Huge thanks again to all who have been part of CFC’s journey so far: employees, investors, capacity providers and of course our broker partners.

Here's to the next 25 years of innovative insurance with CFC.