CFC’s CORSIA Guarantee Insurance (CGI) has been approved by Gold Standard.

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a global, market-based mechanism developed by the International Civil Aviation Organization (ICAO) to address CO₂ emissions from international flights.

Its goal is to achieve carbon-neutral growth from 2020 onwards by requiring airlines to monitor, report and offset emissions that exceed a defined baseline level. Under CORSIA, airlines must purchase eligible carbon credits to compensate for emissions above the baseline.

How CORSIA is being rolled out

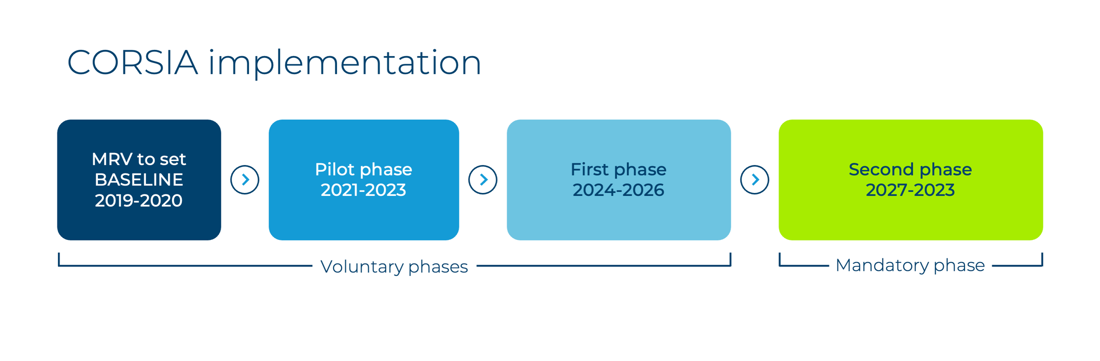

CORSIA is being implemented in three phases, allowing for gradual participation and capacity building among states:

- Pilot Phase (2021–2023): Voluntary participation by early adopters

- Phase I (2024–2026): Continued voluntary participation for ICAO states

- Phase II (2027–2035): Becomes mandatory for most member states, excluding those with minimal aviation activity or classified as Least Developed Countries (LDCs)

CORSIA operates on three-year compliance cycles meaning the next compliance deadline for airlines to surrender eligible CORSIA-units under the current Phase I period is 31 January 2028.

Why CORSIA matters for the carbon market

With the transition from the Pilot Phase (2021–2023) to Phase 1 implementation (2024–2026), CORSIA marks a pivotal step toward a fully operational global compliance framework for aviation emissions. What began as a voluntary testing period has evolved into a structured mechanism that now engages a broader group of states and airlines in mandatory emissions monitoring, reporting and offsetting (MRV).

Phase 1 also introduces the requirement for corresponding adjustments, a key provision designed to align CORSIA with the Paris Agreement’s Article 6 framework. This ensures emission reductions are accounted for transparently and prevents double counting, reinforcing environmental integrity while bridging the compliance and voluntary carbon markets.

As airlines adapt to these new obligations, the aviation sector is increasingly seeking CORSIA-eligible credits, evaluating credit quality, navigating evolving regulatory guidance, and investing in high-integrity offset projects to maintain compliance.

As the scheme scales, it is expected to:

- Boost demand for high-quality carbon projects worldwide

- Align international aviation with the 1.5°C climate pathway

- Catalyze investment in carbon projects and sustainable aviation fuel (SAF) innovation

Market challenges for buyers and sellers

While CORSIA is a major step forward for aviation decarbonization, the market faces a critical supply shortage. During Phase I (2024–2026), the aviation sector is expected to need between 100–150 million CORSIA-eligible credits – yet only 7.14 million have been issued to date.

This shortfall stems from structural challenges:

- Political risk due to varying levels of Article 6 readiness and institutional infrastructure.

- Lack of investment from project developers due to revenue and regulatory uncertainty

This is where insurance can step in – to address political risk and help unlock new revenue streams by helping projects become CORSIA-eligible.

The role of insurance: De-risking CORSIA participation

Navigating the CORSIA market requires confidence in both the integrity of carbon credits and the reliability of delivery. CFC offers two distinct insurance products designed to support both project developers and airline buyers as they engage with the scheme.

- Unlocking supply: CORSIA Guarantee Insurance (CGI): For project developers, CGI covers political and corresponding adjustment risks – providing financial assurance that credits will retain their CORSIA eligibility by meeting the mandated registry requirements.

- Boosting demand: Carbon Delivery Insurance (CDI): For airline buyers, CDI protects against non-delivery, invalidation or loss of CORSIA eligibility for forward-purchased credits. This all-risks cover gives procurement teams the confidence to secure early supply while managing price volatility and regulatory change.

Learn more about CGI and CDI insurance here.

Together, these solutions help build trust in the CORSIA markets, supporting credible participation and enabling climate action at scale.

Let’s help the carbon market grow, together

CFC is proud to be one of the first private insurers approved by Gold Standard to support the CORSIA scheme – a milestone for both aviation and the carbon market. This recognition highlights the vital role insurance plays in unlocking high-integrity carbon supply and building market confidence.

To learn more about our CORSIA carbon insurance solutions and how they can support secure, scalable participation, get in touch today.