-

AI-accelerated cyber attacks a growing threat

AI is reshaping the threat landscape – not through sci-fi-style super-attacks, but by quietly multiplying attacker efficiency. Threat actors are increasingly using AI tools to automate reconnaissance, customize phishing campaigns and gain initial access to targeted systems faster, and at greater scale.

At the same time, deepfake voice and video tools are making impersonation more convincing – raising success rates for phishing, business email compromise and fraud. Threat actors are even using AI to sift stolen data and maximize their ransom leverage. With use cases emerging constantly, businesses need to ensure they have the right cyber protections in place – with cyber insurance a key part of the puzzle.

-

Data theft & extortion take center stage

Ransomware groups are increasingly skipping the encryption stage and going straight to data theft, then extorting organizations by threatening to leak what they’ve stolen. It’s a cheaper, faster tactic that cuts development costs and still delivers strong leverage – especially for organizations with sensitive IP or high regulatory risk.

Attackers are still getting in via the same low effort routes: internet exposed services, unpatched vulnerabilities and reused or default credentials. In other words, many of the same weaknesses are still being exploited. That’s why basic cyber security hygiene – combined with proactive cyber attack prevention services available through good cyber insurance – are a must for 2026.

-

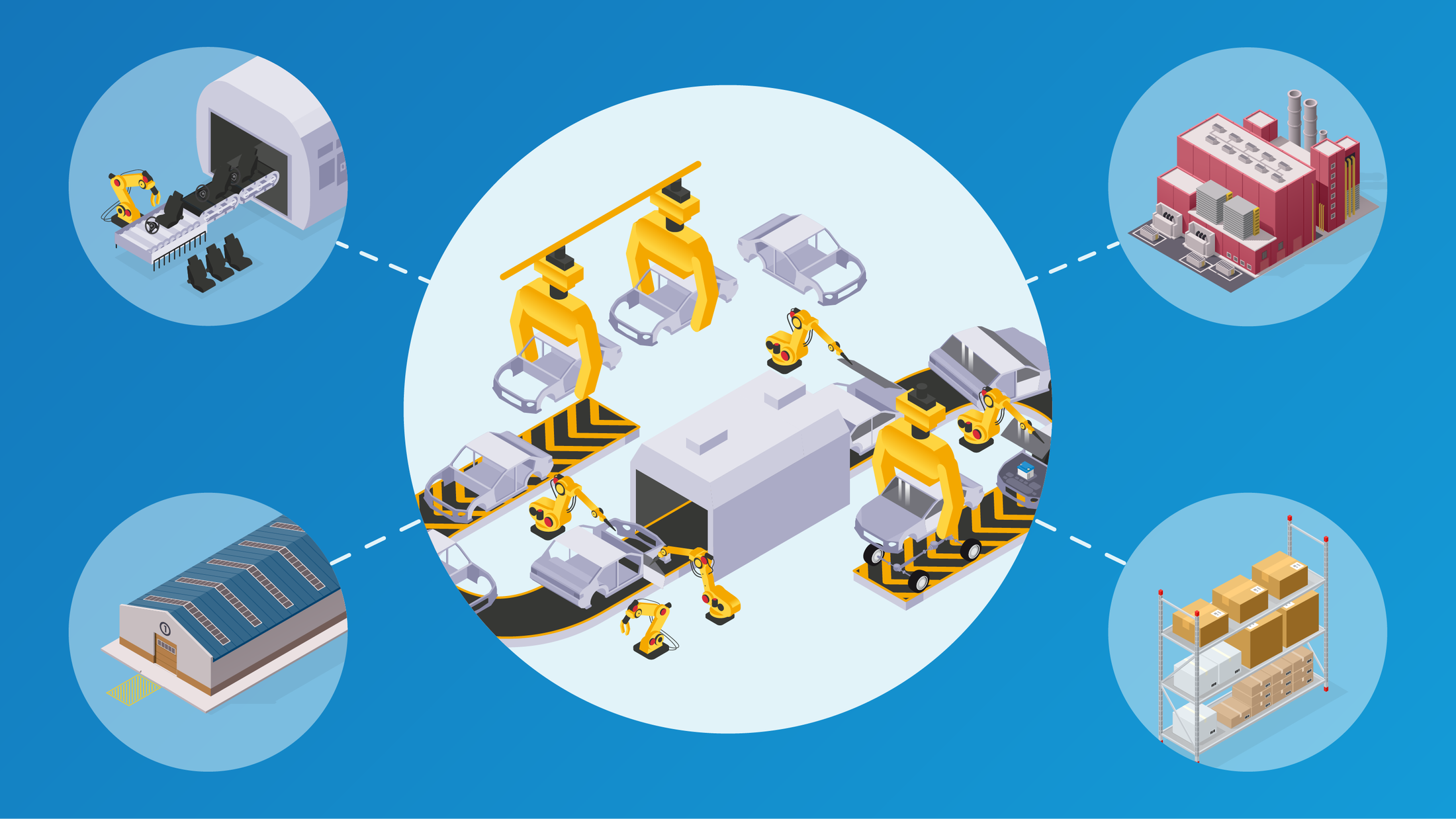

Two-way supply chain cyber exposure in the spotlight

Cyber incidents continue to amplify risk across end-to-end supply chains, upstream to suppliers and downstream to customers – a risk that is not always covered by cyber policies. In 2026, expect the spotlight to shine on downstream disruption just as much as events upstream, as major events like the Jaguar Land Rover cyber incident show how disruption at the customer end can halt purchasing, trigger order cancellations and leave inventory stranded.

To address this gap, customer business interruption cover is emerging as a critical extension. This protection covers businesses when a customer’s cyber event stops them purchasing, whereas traditional policies focus on first party or supplier failure alone.

Ready to lead the change?

In 2026, the cyber market is geared for rapid change. We’re anticipating a greater volume of threats, as threat actors leverage AI, alongside a brighter spotlight on customer business interruption driven by high-profile, systemic incidents. In this landscape, cyber coverage has to keep up.

At CFC, we’re innovating constantly to help protect businesses in an ever-changing threat landscape.

If you’d like to learn more about threat trends and how CFC’s market-leading cyber cover works, get in touch.