Supply chains are more connected, and more exposed, than ever. A single cyber attack on one major business can have an immediate and devastating knock-on effect on the suppliers who rely on that customer to purchase their goods or services. This means, a business doesn’t even need to suffer a cyber incident to feel the financial impact.

With the National Cyber Security Centre (NCSC) and other government bodies now focused on this risk, as discussed by James Burns, our Global Head of Cyber, we’ve developed a customer business interruption (BI) extension to help cover this critical gap in coverage, giving businesses greater protection than ever.

What is customer business interruption

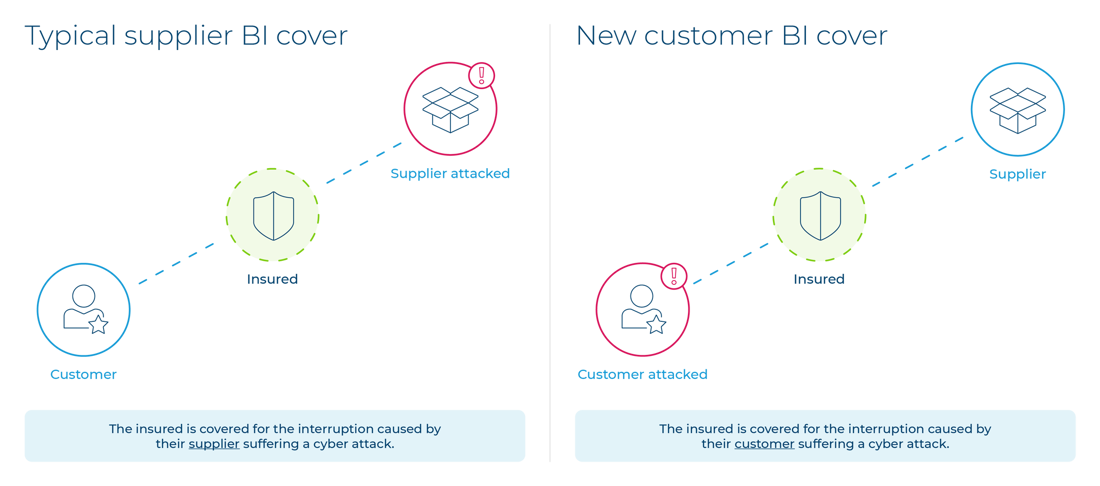

Traditional cyber policies focus on two areas of business interruption. First, direct or first party business interruption covers income loss when the insured’s own systems are taken offline by a cyber incident. Second, supplier or dependent business interruption covers income loss when a business, that the insured depends on for the provision of goods or services has a cyber incident, which then impacts the insured’s business operations.

What has been missing is protection against cyber incidents impacting insured’s customers. Customer business interruption cover responds when the insured’s customer suffers a cyber incident and decides to no longer purchase goods or services from the insured due to the impact on their business - resulting in a financial loss for the insured.

Business benefits: Protecting lost revenues from supply chain disruption

For SMEs that depend on a few major clients for most of their revenue, imagine a crucial customer experiences downtime as a result of a malicious cyber event, the SME's cash flow can be seriously jeopardized.

That’s why customer business interruption cover is so valuable. With this in place, SMEs in a supply chain gain a more complete business interruption solution that protects income whether a cyber incident hits their own systems, their suppliers or their customers. It gives smaller businesses confidence that their most important customer relationships, and income streams, are safeguarded against sudden and unexpected cyber interruptions. Supporting economic resilience and giving SMEs a way to keep their business afloat without resorting to extreme measures or emergency funding.

For brokers, this coverage offers a real opportunity to protect businesses at a time when supply chain risk is front of mind. The benefit is clear: customer business interruption cover helps protect revenue tied to key contracts, cushions the impact of cash flow disruptions, and keeps relationships stable during a customer outage. It closes a long-standing gap in the market and gives SMEs the resilience they need in today’s unpredictable cyber landscape.

Customer business interruption in action

A major car manufacturer experiences an impactful and extended cyber attack. Hundreds of smaller suppliers, who provide the vast array of parts needed for the manufacturer’s cars, suddenly have their orders cancelled, causing significant financial strain.

Customer business interruption cover is designed precisely for this scenario. Insureds with this extension in place will be reimbursed for any income loss caused by the cancellation or material reduction of orders, giving them the financial stability to stay operational until their customer is back up and running, and placing orders from them again.

How the coverage works

Available by endorsement on CFC’s Cyber Proactive Response policy for SMEs, coverage can provide protection for named suppliers you choose to purchase coverage for. The coverage is:

-

Scheduled and tailored

The insured selects the customer or customers they rely on most and would like to purchase coverage for, with each named customer having its own agreed aggregate limit.

-

Triggered by a cyber attack on the insured’s named customer

Coverage applies when a customer experiences a malicious cyber event that forces them to halt or reduce purchasing from the insured.

-

Aligned with existing business interruption structure

Customer business interruption cover complements first-party business interruption and dependent supplier business interruption so the client has enhanced protection across their entire operational chain.

Building a better future for supply chain security

Customer business interruption cover marks a major step forward in cyber insurance, reflecting the interconnected nature of modern commerce and giving SMEs strong protection against a growing risk. For brokers, it’s a powerful new tool for clients whose revenue depends on a few key customers.

CFC has long led the way in comprehensive cyber cover, and this extension continues that leadership by addressing one of the most pressing, underinsured exposures in today’s supply chains. With SME cyber uptake still lagging, customer business interruption cover offers another compelling reason for small businesses to consider cyber insurance for the first time.

To access this endorsement for your clients, please email your CFC cyber underwriter or via cyber@cfc.com.